Bitcoin’s Price Soars Over $106,000: A New Era for Cryptocurrency?

In an unexpected twist, Bitcoin has surged past its previous record high, surpassing $106,000, driven by indications of a significant policy shift from incoming U.S. President Donald Trump. Amid speculation about Russia potentially creating a Bitcoin reserve before the U.S., concerns are escalating regarding the Federal Reserve’s future economic strategies.

Recap of the Bitcoin Boom

The cryptocurrency market has experienced an impressive surge, with Bitcoin’s value more than doubling since its August lows. This upswing is partially attributed to vocal endorsements from influential figures like Tesla’s CEO Elon Musk, whose recent remarks have cast doubt on the future stability of the U.S. dollar.

Insights from Experts

“We anticipate stagflation emerging by 2025, which would present the Federal Reserve with its worst-case scenario,” analysts from The Kobeissi Letter shared on the X social media platform. They highlighted warnings from the asset management company Apollo, which foresees a resurgence in inflation by 2025, contrary to predictions of a softening that may prompt interest rate decreases. Apollo’s chief economist, Torsten Sløk, posed a critical inquiry: “Are we heading towards a replay of the 1970s when the Fed reacted too swiftly, fueling inflation?”

Prominent billionaire investor Ray Dalio has also cautioned about an imminent “debt crisis” that could significantly devalue the U.S. dollar. With the national debt exceeding $34 trillion at the beginning of 2024, largely due to pandemic-related relief spending, the economic and cryptocurrency landscapes appear precarious.

Market Dynamics at Play

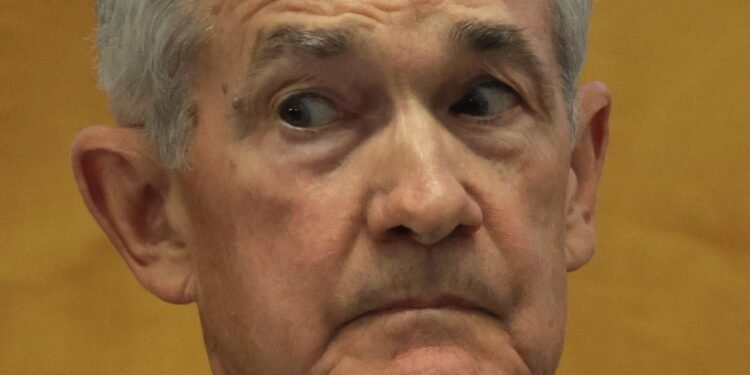

Despite recent inflation data showing an upward trend, the Federal Reserve is expected to decrease interest rates by 0.25% this week. There is a consensus among economists that there could be three further rate reductions in 2025. Nevertheless, a survey by the Financial Times hinted at the Fed adopting a more careful approach, driven by concerns that Trump’s policies—ranging from substantial tariffs to tax cuts—might trigger higher inflation.

Economic specialist Jonathan Wright, formerly with the Federal Reserve and now at Johns Hopkins University, observed, “While inflation has declined more smoothly than predicted, reaching target levels will likely pose a tougher challenge, prompting the Fed to refrain from hasty rate cuts.”

Impacts on Bitcoin and the Market

The prospect of interest rate cuts has injected vitality into Bitcoin’s price surge, prompting analysts to predict further growth in the upcoming weeks. Alex Kuptsikevich, FxPro’s chief market analyst, explained, “The recent climb to all-time highs, culminating in this morning’s surge above $106,000, reinforces a bullish outlook. This momentum is especially noteworthy following a three-week consolidation near the $100,000 level. Unless unforeseen events emerge in traditional financial markets, an uptick in growth appears imminent.”

Wrapping Up

The recent upsurge in Bitcoin’s value, coupled with changing economic forecasts and influential policy shifts, has cast cryptocurrency in a potentially favorable light. Analysts caution of imminent economic challenges for the Federal Reserve, while the ongoing rise in Bitcoin’s value signals a probable paradigm shift in the cryptocurrency realm. As this narrative evolves, investors and economists alike will closely watch for developments that could redefine the future of finance.