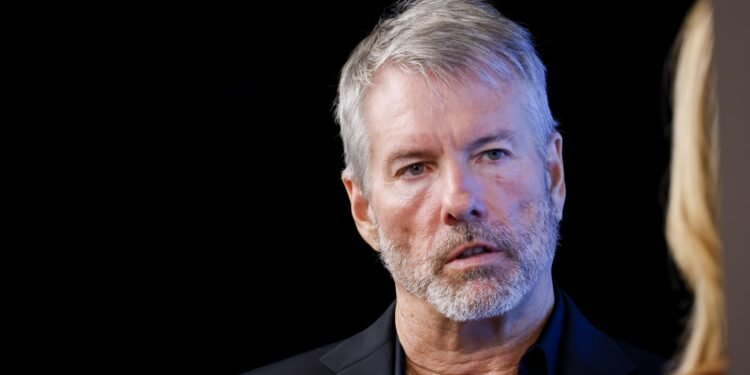

Michael Saylor Promotes Bitcoin Investment, Stirring Debate at Microsoft Conference

In December 2024, the chairman and CEO of MicroStrategy, Michael Saylor, made headlines by advocating for Microsoft to consider investing a portion of its significant cash reserves into Bitcoin, a move reflecting his unwavering support for the cryptocurrency that has revolutionized his company’s success. Despite facing rejection from Microsoft shareholders, Saylor’s campaign continued to generate interest, sparking crucial discussions on the future of corporate investment in digital assets.

Reflecting on MicroStrategy’s IPO debut in June 1998, Saylor reminisces about the electric atmosphere surrounding the event. Sitting in a lavish suite at the Lotte New York Palace and witnessing a remarkable 76% spike in stock value on the first trading day, Saylor recalls the thrill of the tech industry boom. “It was a remarkable day,” Saylor recently shared in an interview with CNBC.

More than 26 years later, Saylor once again finds himself in the limelight, this time advocating for the integration of Bitcoin into Microsoft’s growth strategy. His presentation to Microsoft shareholders, garnering over 3.6 million views, underscored the vital importance of the tech giant embracing Bitcoin as the “next technological wave.”

Market analysts view Saylor as a visionary with a polarizing touch. While his bullish stance on Bitcoin has dramatically boosted MicroStrategy’s market value from around $1.1 billion to approximately $82 billion, critics remain cautious. Peter Schiff, the chief economist at Euro Pacific Asset Management, has criticized Saylor’s investment tactics as a “ponzi loop,” warning investors about potential risks of using debt leverage to buy Bitcoin.

In the broader context, MicroStrategy’s adoption of Bitcoin positions the company uniquely as an appealing investment avenue for institutions seeking exposure to the cryptocurrency market. This distinction is amplified as the SEC recently sanctioned spot Bitcoin exchange-traded funds (ETFs), enhancing market access for institutional investors. Despite constructive regulatory shifts, Saylor’s vision encounters significant skepticism in financial circles.

Saylor’s fervent endorsement of Bitcoin carries dual implications. On one side, his buoyant enthusiasm aligns with a generally optimistic sentiment in the cryptocurrency sector, notably following Donald Trump’s more favorable stance on Bitcoin. Since Trump’s win, Bitcoins value has surged by around 41%, in parallel with MicroStrategy’s bold accumulation strategy of acquiring 249,850 Bitcoins this year.

However, the financial sector, while intrigued, remains cautious. Some analysts caution that Bitcoin’s volatility may introduce risks challenging traditional investment strategies. Saylor himself openly acknowledges these risks, having experienced MicroStrategy’s stock plummeting by 74% in 2022 before its recovery.

In his unwavering commitment to Bitcoin, Saylor makes bold predictions, foreseeing the cryptocurrency reaching $13 million by 2045, highlighting its significance in shaping the future digital economy. “Every day is a good day to invest in Bitcoin,” he boldly declares, urging companies to reconsider their cash management methodology by integrating digital assets.

In summary, Saylor’s robust Bitcoin strategy has not only propelled MicroStrategy’s valuation but also ignited a discourse on the prudence of corporate cryptocurrency investments. As the landscape evolves and regulatory frameworks clarify, the ramifications for established corporations and emerging ventures alike will undoubtedly influence the future of digital asset investment in the forthcoming years.