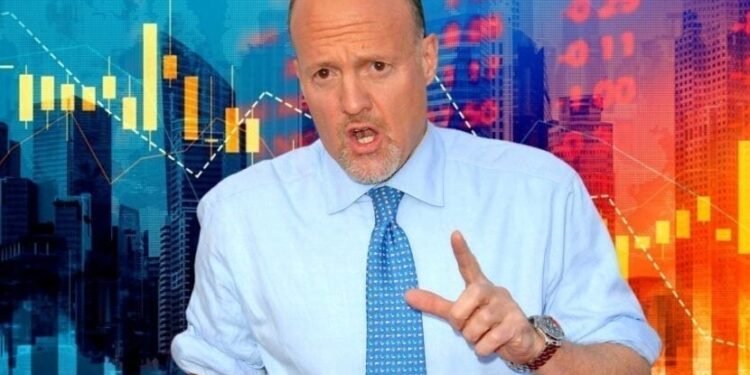

Insight: Jim Cramer’s Stance on Bitcoin and MicroStrategy Shares

Overview:

During a recent segment on his program “Mad Money,” financial guru Jim Cramer voiced his support for Bitcoin as a valuable asset for investment portfolios. Conversely, he highlighted concerns regarding the purchase of MicroStrategy shares, a major player in the Bitcoin market.

Professional Viewpoint:

Cramer made a strong statement on air, asserting, “If you’re considering Bitcoin, then Bitcoin it should be. I personally hold Bitcoin, and I recommend it for your portfolio. It’s a smart addition.” While Cramer’s endorsement aligns with the increasing mainstream acceptance of Bitcoin, his historical market predictions have at times been met with skepticism.

Financial Landscape:

Under CEO Michael Saylor’s guidance, MicroStrategy has aggressively acquired Bitcoin, amassing a substantial 471,000 coins with a current value exceeding $48 billion. Recently, the company added over 10,000 Bitcoins to its reserves at an average cost of around $105,596 per coin. Despite Cramer’s favor towards Bitcoin, he refrained from detailed reasons behind his reservations about MicroStrategy, potentially leaving investors uncertain.

Market Analysis:

Cramer’s mixed signals add complexity to the world of cryptocurrency investment. His critique of MicroStrategy shares, coupled with past negative comments on Bitcoin – notably a major warning in January 2024 – have positioned him as a contradictory figure among investors. Interestingly, following Cramer’s bearish remarks, Bitcoin experienced a considerable recovery, surging over 100% since January. At present, Bitcoin sits just below $103,000, marking a 1.5% increase from the prior day.

Wrap-up:

Jim Cramer’s recent endorsement of Bitcoin and his cautious tone on MicroStrategy highlight the intricate nature of cryptocurrency investments. While his backing may sway some to explore Bitcoin, Cramer’s fluctuating track record underscores the importance of thorough evaluation. Investors are advised to maintain a watchful eye and undertake comprehensive research when navigating the volatile cryptocurrency market.