Bitcoin Maintains Lead in Asset Performance for 2024: Ethereum Struggles to Match Pace

Within the realm of digital assets, Bitcoin stands as a benchmark for performance, showcasing an impressive compound annual growth rate (CAGR) of 63%. Despite witnessing a recent decline in price, Bitcoin remains a standout performer for the year, registering gains of approximately 30%. Meanwhile, Ethereum faces the challenging task of closing the gap with Bitcoin’s dominance.

The introduction of an Ethereum exchange-traded fund (ETF) recently resulted in over $2.2 billion exiting Grayscale’s Ethereum Trust (ETHE), causing temporary price fluctuations. However, a rebound in inflows over the past few trading sessions suggests that this hurdle may have eased.

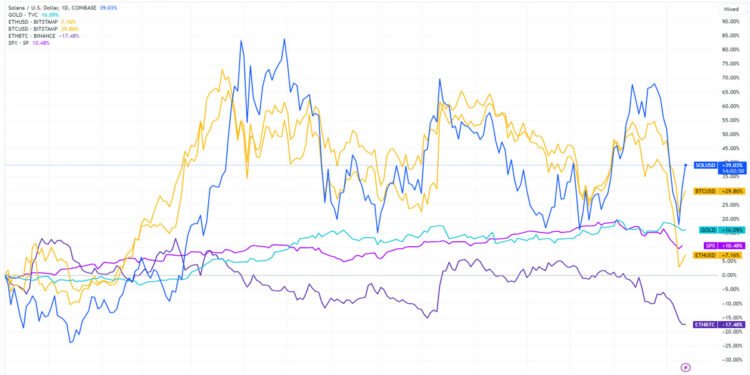

Thus far in 2024, Ethereum has exhibited a modest 8% uptick, trailing behind both gold (with a 16% increase) and the S&P 500 (up 11%). The year has also seen the ETH/BTC ratio decline by 17%, settling at a modest 0.043. In contrast, Solana has surged by 40% year-to-date, outperforming Ethereum in the current calendar year.

A delve into historical data from Coinglass highlights that Ethereum’s returns averaged at 18.08% in the first half (H1) of the year, notably dropping to 3.61% in the second half (H2). On the flip side, Bitcoin realized an H1 return of around 8.83% and an H2 return of 13.24%. These trends suggest a widening gap between Bitcoin and Ethereum performance based on past trends.

In navigating the ever-evolving cryptocurrency landscape, thorough research and due diligence play a crucial role in making informed investment decisions. Understanding such market trends is pivotal for investors in making sound choices in an industry known for its dynamism.