Forecast by Dan Tapiero: Bitcoin Set for Growth Amidst Market Uncertainty

With recent turbulent market conditions influenced by escalating tariffs, macro investor Dan Tapiero suggests that Bitcoin could soon outperform traditional stocks like the S&P 500 index. The increased volatility witnessed in the stock market due to changes in US fiscal policies has prompted Tapiero to shed light on the potential of Bitcoin as a safe haven for investors.

Tapiero recently shared his views with his 127,800 followers on X social media platform, emphasizing that Bitcoin seems poised for a significant upward trend. He attributes this optimism to the ongoing stock sell-offs triggered by President Donald Trump’s tariffs, causing widespread market concerns.

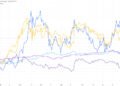

“Bitcoin is at a critical turning point,” he remarked. “With tariffs impacting conventional markets and the Volatility Index reaching 40, there’s a prevailing sense of fear. The Nasdaq-100’s sharp decline suggests imminent rate adjustments, albeit gradually. Comparing BTC to SPX charts suggests an impending surge.”

According to Tapiero, Bitcoin offers a stark contrast to the intricate nature of traditional finance dealing with government expenditures, foreign exchange manipulations, and geopolitical challenges. He argues that as a decentralized asset, Bitcoin is unburdened by traditional constraints, presenting a valuable opportunity amidst the current chaos.

Tapiero also points out the potential repercussions of Trump’s tariff hikes, indicating a hindrance to economic growth and fostering an environment filled with uncertainty. In this scenario, Tapiero views Bitcoin and gold as potential safe havens against the looming recessionary threats. “It’s unfortunate that these developments may lead to reduced US growth and sustained uncertainty. We might see a noticeable drop in interest rates ahead. Gold and Bitcoin could serve as safe retreats,” he highlighted.

At present, Bitcoin is valued at $83,805 in trading, showing a 1.5% increase over the past 24 hours, signaling a growing investor inclination towards the digital currency amidst turbulent market scenarios.

In summary, Dan Tapiero’s analysis emphasizes the significant role Bitcoin could assume as an alternative to conventional investments, especially in light of recent economic shifts. With market volatility and potential recession looming, the digital asset might emerge as a strategic investment for risk-averse investors seeking stability and growth opportunities in uncertain times.

Disclaimer: The viewpoints expressed here are not financial advice. It is recommended that investors conduct thorough research before venturing into high-risk investments involving Bitcoin, cryptocurrencies, or other digital assets. All transactions are carried out at the investor’s discretion, and any resulting losses are their own responsibility. The Daily Hodl does not endorse the trading of digital currencies or serve as an investment consultant.