Exploring Recent Events Shaping the Cryptocurrency Scene

A Glimpse into the Cryptocurrency World

The world of cryptocurrency remains in constant flux, with groundbreaking announcements, technological progress, and regulatory hurdles. Recent news involving Bitcoin, Ethereum, Binance, Solana, and Ripple underscores the ever-changing and innovative nature of this industry.

Insights from Industry Experts

Rumors surrounding former President Donald Trump’s alleged initiation of a Strategic Cryptocurrency Reserve have stirred excitement within the crypto community. This purported initiative, poised to include top cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), aims to solidify the U.S.’s foothold in the global crypto arena. Crypto specialist Melissa Wright remarked, “This move could reshape institutional attitudes towards cryptocurrency, hinting at increased acceptance and regulatory clarity.”

Analyzing the Market Landscape

On March 2, 2025, Trump’s announcement caused significant market upheaval, with XRP witnessing a 21% surge, SOL climbing by 12.5%, and ADA skyrocketing by 37%. This surge signifies growing investor confidence in the future inclusion of crypto assets in conventional financial systems. The strategic reserve seeks to counteract the perceived regulatory excess of previous administrations, potentially spurring institutional adoption.

Concurrently, global asset management giant BlackRock has made waves by integrating Bitcoin into its investment cache, dedicating around 1-2% to its Bitcoin ETF (IBIT). With holdings of 576,046 BTC, BlackRock now commands 2.9% of the circulating supply. This move may signal wider acceptance of cryptocurrencies in traditional finance, encouraging other institutional players to follow suit.

Analysing the Impact

However, not all recent developments have been positive. Ethereum is confronting hurdles related to its Pectra upgrade, facing challenges on the Holesky testnet, potentially destabilizing the network’s reliability. A stumbling block in integration has delayed crucial updates aimed at improving transaction finalization, prompting developers to expedite solutions. Failure to resolve these issues could see Ethereum losing ground to efficient rivals like Solana, heightening the need for speedy resolutions.

Offsetting this is MetaMask’s revelation of a significant interface revamp, enabling users to transact in various tokens sans gas fees from May 2025. This enhancement pledges to elevate user experience for its substantial 30 million active users, positioning MetaMask as a frontrunner in the Web3 wallet realm, intensifying competition against other multi-chain solutions.

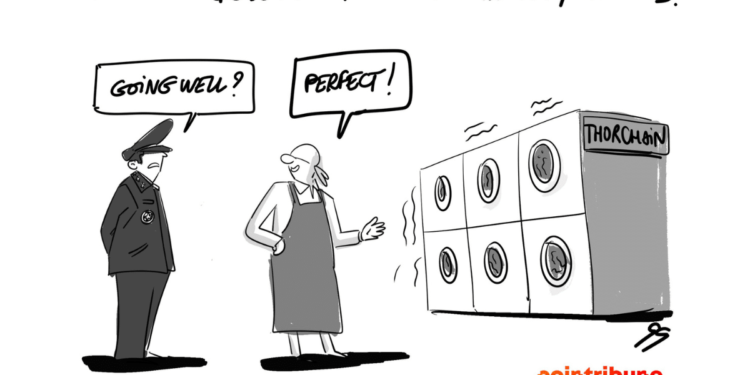

The crypto community was also shocked by the news that $605 million from the Bybit hack was laundered through THORChain, a decentralized protocol with no KYC prerequisites. While enforcement agencies collaborate to trace the illicit funds, debates within the community about striking a balance between preserving user privacy and preventing money laundering are escalating.

In a separate, but equally significant legal occurrence, Coinbase emerged victorious as the SEC dropped its charges after a prolonged legal battle. This verdict not only validates Coinbase’s operational adherence but also calls for clearer regulatory frameworks within the crypto sphere. Legal authority Thomas Reed remarked, “This could establish a pivotal precedent for similar cases involving other crypto entities, fostering a more conducive environment for innovation.”

Wrapping Up

In conclusion, the past week in cryptocurrency has seen a mix of impactful developments and challenges, showcasing the dual nature of opportunities and setbacks in the industry. The proposed establishment of a Strategic Cryptocurrency Reserve by the U.S., alongside strides and stumbling blocks across established platforms, highlights a continuously evolving landscape. As cryptocurrencies become increasingly intertwined with institutional operations, the implications for market structures and regulatory frameworks are profound, setting the stage for a more interconnected financial future. To stay abreast of ongoing updates and in-depth analyses, subscribing to our weekly newsletter is highly recommended.