Headline: Impactful Market Shift: SEC Gives Green Light to BlackRock’s iShares Bitcoin Trust Options

Opening Insights:

In a significant move, the U.S. Securities and Exchange Commission (SEC) has sanctioned options trading for BlackRock’s iShares Bitcoin Trust (IBIT) spot exchange-traded fund (ETF), presenting investors with fresh avenues for managing risks and taking advantage of Bitcoin’s price fluctuations.

Expert Viewpoint:

Experts at CryptoQuant underline the importance of this milestone in ramping up both liquidity and investor involvement in the Bitcoin realm. They believe that introducing options trading could notably boost institutional interaction with Bitcoin, offering more structured investment possibilities.

Current Market Landscape:

This approval comes at a time when the cryptocurrency market is showing robust expansion. Recent statistics show that on March 12, open interest in Bitcoin options on the Chicago Mercantile Exchange (CME) soared to around $500 million, marking a notable surge compared to earlier periods. This data underscores a growing interest in Bitcoin-related instruments, particularly among those looking at long-term investments.

Analyzing the Effect:

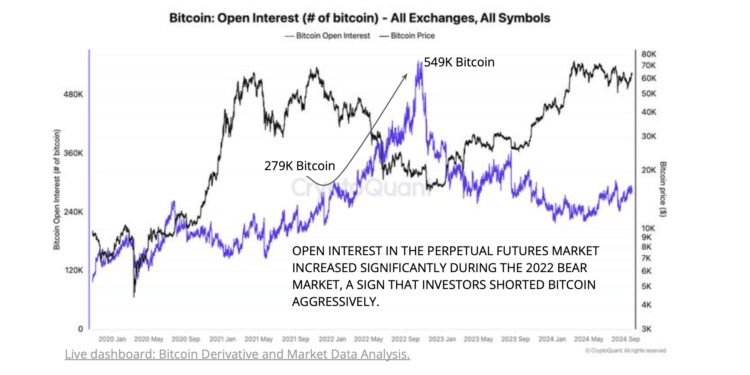

The introduction of options on the IBIT ETF could become a game-changer for investors, enabling them to generate returns through strategies like selling covered calls. This tactic, allowing investors to own Bitcoin while also selling call options, presents a regulated way to earn from their assets. Presently, CME Bitcoin futures are yielding around 5% annually for contracts beyond six months. Nevertheless, caution is warranted as introducing options could boost the “paper” supply of Bitcoin, allowing investors to gain exposure to the asset without directly entering the spot market, a trend seen before in the perpetual futures market.

Final Thoughts:

To summarize, the SEC’s nod for options on BlackRock’s iShares Bitcoin Trust marks a substantial development that could reshape Bitcoin trading dynamics. By introducing new financial tools, it encourages broader market participation and deeper liquidity. Yet, investors need to stay mindful of the potential effects on Bitcoin’s supply dynamics and keep an eye on forthcoming regulatory steps, particularly with endorsements from the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC). The evolving landscape holds promise for increased institutional acceptance in the crypto sector.