Key Event: Large Bitcoin Options Expiry Could Heighten Volatility

Overview:

This upcoming Friday at 08:00 UTC, approximately $5 billion worth of Bitcoin (BTC) options contracts are due to expire on the Deribit exchange, contributing to the already increased volatility in the cryptocurrency world.

Expert Insights:

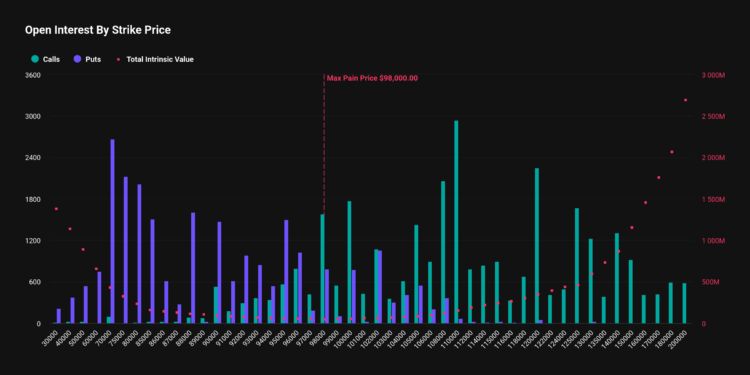

Expert analysis is closely watching the outcomes of this significant options expiration event. PowerTrade commenting on the matter said, “Bitcoin options traders need to monitor the situation closely as we approach the month’s end. With a max pain point of $98,000 set for February 28, there is considerable open interest around this figure. This concentration of interests might lead market makers to influence Bitcoin’s price movement towards this max pain level,” underscoring the potential for heightened market fluctuations.

Current Market Scenario:

Throughout 2025, Bitcoin has been characterized by an extended phase of price consolidation, which resulted in Deribit’s volatility index (DVOL) showing a downward trend. However, a recent sharp decline in Bitcoin’s value has altered this pattern, causing DVOL to briefly surge to 52 before dropping back below 50, indicating a sudden rise in market anxiety. The recent fall below $90,000 has rendered a majority of options contracts out-of-the-money (OTM), causing significant unrealized losses for traders.

Analysis of Impact:

Deribit’s data unveils that a substantial $3.9 billion—or 78%—of the expiring options are OTM and are therefore expected to expire worthless. This is mainly due to the sharp decrease in Bitcoin’s value, resulting in almost all call options (bullish speculations) being OTM. On the other hand, the remaining $1.1 billion (22%) consists of in-the-money (ITM) put options, which retain value as their strike prices surpass the current market rate. The significant max pain level set $10,000 above the current market price indicates a strong incentive for options sellers to boost Bitcoin’s market value in order to maximize their gains when their positions push the price towards this threshold.

Concluding Thoughts:

As the substantial $5 billion Bitcoin options expiration nears, market participants should brace for increased volatility and potential price maneuvers towards reaching the $98,000 max pain level. With a considerable number of options contracts expiring worthless and a substantial portion still holding value, the aftermath of Friday’s events could have broad implications for traders and the overall cryptocurrency market. The unfolding scenario will be closely watched to see if the max pain theory materializes and shapes Bitcoin’s price trajectory in the days to come.