Title: Concerns Rise in Asian Markets Over China’s Economic Approach

Overview:

A downturn in Asian stock markets followed China’s recent debt swap initiative, leaving investors dissatisfied with the proposed solutions for the country’s economic challenges. This negative sentiment was exacerbated by data indicating persistent deflationary pressures in the region.

Perspective:

Reflecting on the market’s reaction, Andy Maynard, the head of equities at China Renaissance Securities, voiced apprehension, attributing the negativity to a premature interpretation of the stimulus measures. In a Bloomberg TV interview, Maynard suggested that more lies behind the stimulus and cautioned that market volatility is likely to linger in the near term.

Market Highlights:

A regional equity gauge dipped by over 1%, driven by early losses in Hong Kong and mainland Chinese shares, alongside decreasing benchmarks in South Korea and Australia. Conversely, US futures saw a modest uptick following a 0.4% increase in the S&P 500 on Friday. Despite unveiling a 10 trillion yuan ($1.4 trillion) debt risk mitigation program for local governments, Beijing’s lack of substantial new fiscal stimuli left investors desiring stronger measures to bolster demand.

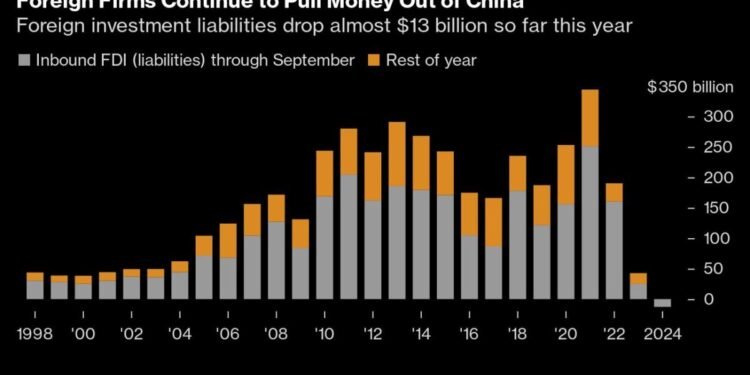

Adding to market jitters, foreign direct investment in China is waning, prompting concerns about sustained economic revival. With uncertainties surrounding trade tariffs post-Donald Trump’s election, many economists interpret China’s cautious fiscal stance as a strategy to preserve flexibility in the face of potential trade challenges.

Impact Assessment:

In response to Trump’s presidency, UBS analysts revised down China’s 2025 growth forecast to approximately 4%, a significant drop from earlier projections. The repercussions of continued economic fragility in China have global implications, notably impacting markets reliant on Chinese demand. Fluctuations in commodities like oil and iron ore underscore China’s economic well-being’s broader market ramifications, with oil prices slipping for a second consecutive day amid forecasts of reduced consumption from the leading importer.

Furthermore, Bitcoin’s recent climb above $81,000 signals growing backing for digital assets post-election, as pro-crypto legislators gain traction. In parallel, scrutiny surrounds the Federal Reserve’s plans, with President Neel Kashkari hinting at a more cautious approach to interest rate adjustments amidst a robust US economy.

Wrap-Up:

In essence, the recent market declines in Asia spotlight heightened concerns about China’s post-election economic strategies, underlined by tepid reactions to new debt initiatives and ongoing deflationary trends. As traders monitor forthcoming economic data and Federal Reserve communications, the potential for significant market shifts remains tangible. Investors must navigate these nuances, closely monitoring policy developments and economic indicators in the upcoming week, poised to influence both regional and global markets in the long run.